Aragon has been flooded with megafarms, particularly in the last decade. Since overtaking Catalonia in 2017, Aragon leads Spanish regions when it comes to pig livestock in Spain. In 2022, it already had places for nearly 10 million animals spread across 4,577 farms with more than 1,000 fattening places or more than 400 mothers.

More than half are in municipalities with less than 1,000 inhabitants, which means that in 6 out of 10 municipalities there are more pigs than people.

Some of Spain’s most important pork exporters have chosen to develop in the Aragón region, and their business model is a key part of the plan. These corporations have received millions in public aid, regulatory support and backing from public administrations, in exchange for their investments in sparsely populated areas where a large part of the population already lives from pork farming in one way or another.

How did the current situation come about?

In April 2011, the mayor of Ejea de los Caballeros was the socialist Javier Lambán, now president of the Government of the Autonomous Community of Aragón. He was present during the opening of the feed factory that the Catalan company Vall Companys had built in his town. Investment: 25 million euros, more than any annual municipal budget that Ejea de los Caballeros has ever seen in its entire history. The feed produced in the factory was destined to feed the farms that Vall was merging into their business model, and especially those it planned to have join in central and northern of Aragón, the territory chosen to support its international expansion, especially towards the Asian market, according to the Spanish Commercial Registry.

Integration model

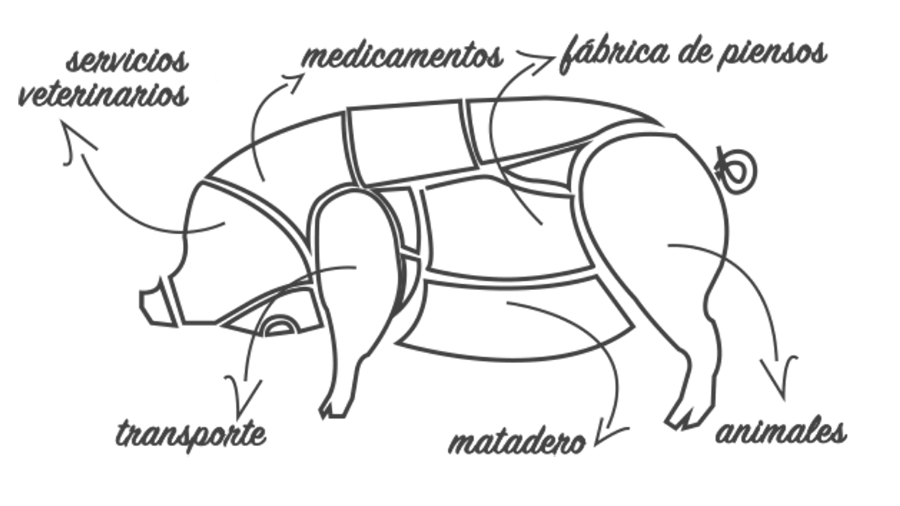

The business model followed by corporations like Vall Companys is an important piece of the puzzle. In Spain, the integrator provides the individual farmer with the piglets (or mothers), feed, medicines, veterinary services and transport of the cattle to and from the farms. Each step of the process is provided by a different subsidiary of the same corporation. The “integrated” farmer, who no longer owns the animals he is farming (although the Government of Aragon refers to them as family livestock), provides the infrastructure and the labor. Farmers also commits to one of the most complex parts of the process, given its polluting potential: the management of the slurry. This step falls consequently outside the responsibility of the corporation.

The Government of Aragón, the Ministry of Agriculture and the European Fund EAFRD supported the project presented by Vall, who by then was already a pig giant, with a grant for 3.2 million euros for the construction of the feed mill, plus 200,000 euros for the Provincial Council of Zaragoza and the City Council of Ejea to acquire the land.

This feed mill was not the last step in the development plans that Vall had for its production centers in Aragón, which replicate those Vall had already built in Catalonia. In 2013, Vall Companys bought the slaughterhouse “Cárnicas Cinco Villas”. Where? In Ejea de los Caballeros. Short distances are fundamental for cost control, which is in turn key to guarantee the cheap market prices made possible by the “integration” model, against which other livestock farming models can hardly compete. However, this implies that the meat farms must be concentrated in specific areas and are increasingly larger in size. Vall has invested tens of millions in the Cárnicas Cinco Villas slaughterhouse facilities, which has gone from slaughtering 705,000 pigs in 2013 (the year of the purchase) to 2.6 million in 2020.

The Catalan group, who according to the Spanish Commercial Registry had a turnover of 531 million euros in 2020, is far from being the only pork “integrator” corporation in the Cinco Villas region or in the rest of Aragón.

Some of the largest commercial groups in the Spanish pork sector see a future in these large and sparsely populated extensions of land, where public support to the development of sector by manifests strongly, both through subsidies and appropriate regulations.

Some of the groups active in this area include Guissona Farms, with a turnover of 2,250 million euros in 2021; Piensos Costa, belonging to Grupo Empresarial Costa, 820 million turnover; and Grupo Jorge, 1,382 million.

Megaproducers

Vall Companys and Costa are included in the world’s pork mega producers list published by Genesus and National Hog Farmer of those who have more than 100,000 breeding sows. Above them in the list are only large groups from the USA, China and some from Brazil.

Spain leads pig livestock production in the European Union, in terms of number of animals, with more than 34 million animals produced annually. It is already the third largest pork producer in the world, only behind China and the United States. In 2021, 58.3 million animals were slaughtered in Spain and 5.2 million tons of meat were produced.

The self-sufficiency rate for pork was 212.5% in 2021, meaning that more than twice as much meat was produced as was destined for domestic consumption

Driving through sparsely populated counties such as Cinco Villas, along their poorly paved roads, endless fields and deserted streets, it can be difficult to grasp to degree to which these regions have become nodes of international trade.

Ejea de los Caballeros, where the PSOE (the Spanish Socialist Workers’ Party) is still in power, together with the neighboring Tauste, governed by the PP (People’s Party), belong to the region known as “Cinco Villas”, which boasts more than one million individual pig pens. Only the depopulated region of Los Monegros, located between the provinces of Zaragoza and Huesca, exceeds Cinco Villas in number of animals.

Situation of the 4,573 active industrial pig farms in Aragon in 2022

There are currently 58 intensive pig farms in Tauste. Because of the number of pens or stalls they have, they can be classified as macrofarms since they are required by law to register their methane and ammonia emissions in the State Register of Emissions and Pollutant Sources (PRTR). Another 53 such farms are located in the municipality of Ejea de los Caballeros. These two municipalities are among the ones with the highest number of industrial livestock farms in Spain and are top emitters of industrial livestock-related methane and ammonia in Spain.

Why Ejea?

According to official sources from Vall Companys, "Ejea de los Caballeros is an area of Aragon that is well connected, with good infrastructure and that is within the perimeter of a specific area of Spain (the eastern half) where there is livestock experience". The granting of public subsidies, they say, “did not influence anything. They gave us the same subsidies as any other industrial activity.”

When asked about the heavy investments made in the municipality and if there was an initial goal of farms to integrate, they assure that "there was no objective in the number of farms", although the accounts do explain that "the production of the factory of feed" of Ejea, "met in 2020 the planned goals regarding the levels of production" of the feed destined to feed the farms. In 2020, a new “factory expansion” was approved.

To what extent has the commitment to the area and the transport cost reduction strategy of the large integrators been able to influence the concentration of farms in Aragon and especially in some of its territories? Vall Companys recognizes that "it is committed to an area that is within a perimeter where there is an efficient value chain that goes from the farm to the pig processing (slaughter and cutting)."

The rest of the aforementioned integrators have been contacted to also collect their position and a questionnaire has been sent to them by email, the receipt of which has been confirmed. At the time of publication of this work, no response has been received.

Forced to grow

Farm size increases constantly. According to some of the contracting farmers from Tauste (who ask to remain anonymous because the corporations have instructed them not to talk to the press), their involvement with the corporations has allowed many of them to earn money and pay off the loans that most of them had to acquire to get started, but they have also been forced to expand in ways that were often not in their plans. Over time, the corporations have asked for new investments to expand the farms, which in many cases means paying off a loan to take on a new one. As put by one of the farmers, the great fear "when you are in debt" is "that the integrator in one season will stop providing feed (for fattening piglets) or will stop filling the sow farm". It is not just a fear. In each bad season (due for example to a fall in demand or a rise in prices of raw materials) those who do not perform to the minimum monthly standards set by the corporation receive smaller premiums and may then stop receiving cattle altogether, as the above-mentioned sources assure.

The corporation continuously modifies production methods, deadlines and feeding. Competing with the ever-larger farms that continue to be built is increasingly difficult. So is putting together the necessary investments for infrastructure. Money from other sectors and from the provincial capitals has started to arrive to the macro-farming sector and given land scarcity for new installations, municipalities such as Tauste started some time ago selling communal land for the installation of macro-farms.

“All the farms have their integration contract. This contract provides security to the farms and the integrator company; it is a reciprocal security”, continues Valls Companys. "It is of mutual interest and guarantee for both parties that the farms are conditioned to the demands of the administration and prepared to obtain the most optimal possible breeding results and the maximum biosecurity to which one can aspire". With regard to investments, “the company does not “request” [with quotation marks in the answer] investments since the farm is owned solely and exclusively by the farmer. On the other hand, when a farmer who is part of the Group is considering renovating or modernizing his farm, a team from Grupo Vall Companys advises and helps in order to achieve better conditions, always taking into account veterinary and construction criteria. In the first case, taking into account the maximum biosecurity and animal welfare; and in the second, seeking to be the most sustainable possible -promoting solar panels, drinking systems and favoring the circular economy-. This ensures that older farms are up to date”.

Fear to the next change of cicle

Farmers' fear of change seems more than justified looking at the figures for 2022. Despite growth in animal numbers and production, Spain already has a problem with exports to China, its main market. China has started to limit exports because it wants to be self-sufficient in five years.

This has translated into a 45% fall in exports to China in the first half of 2022 compared to the same period last year.

The local landscape has changed as a result of the regional expansion of these pork industry giants, some of which come originally from Aragón, such as Costa Food Group, and some, such as Vall, coming from Catalonia due to the saturation that was already taking place there. The changes can be seen at ground level, where one farm is built right next to another, with only the minimum distance required by law to separate them. But underground, coinciding with high farm concentration areas, a huge problem has been developing.

The slurry generated by animals is used to fertilize land, which in principle would be a good thing. But the figures unveil a much less beneficial reality.

Next chapter: Manure stain and nitrates ››